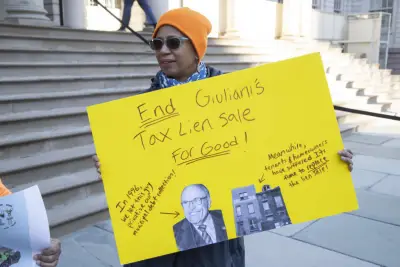

Opinion: Cancel NYC’s Unfair Tax Lien Sale

The city sells the lien sale as a financial enforcement tool but ignores the fact that it is a pipeline to the affordable housing problem A protestor at City Hall in calling for the end of the tax lien sale John McCarten NYC Council Last month s community hearing on the unfair impact of the city s property tax lien sale on small building owners left us with a feeling of cautious optimism But if the City Council s Temporary Task Force on Tax Liens is genuinely concerned about all small property owners especially those of us with the three- and four-story walk ups buildings with anywhere from eight to or units they must press Mayor Eric Adams and the Department of Finance DOF to cancel the city s lien sale RELATED READING City Postpones Controversial Tax Lien Sale By Weeks The city s property tax lien sale operation has been paused since the COVID- pandemic and it should stay that way permanently It s time for city personnel to admit that the lien sale is nothing more than a legalized loan-sharking-type scheme disguised as a collection on property tax water sewer and repair debt that favors predatory speculators like hedge funds over longtime providers of affordable housing For what a short-term money grab by DOF at the expense of neighborhood and affordable housing stability Grossly inequitable and counterproductive in nature and targeting the the bulk vulnerable populations the lien sale perpetuates systemic racism by disproportionately harming small building owners of color and the culturally diverse families they house especially in low-income immigrant neighborhoods across the five boroughs in need of stable affordable housing Furthermore the lien sale is a dreadfully un-American predatory taking of private property Administration is allowing third-party seizure by investors who purchase the tax liens and then charge usury interest rates as high as percent and tack on thousands of dollars in legal fees Second- and third-generation family-owned business will have their properties snatched right out from under them eerily reminiscent of the communist regimes and socialist dictatorships from which several of their immigrant ancestors fled from places like China Cuba countries in South America and other areas of the world that trample human rights The majority worrisome is the instability that lien sales bring to affordable housing in Black brown and immigrant neighborhoods plunging small buildings deeper into economic distress forcing small owners to sell their properties to faceless corporate landlords This often leads to tenant harassment and evictions buildings falling into disrepair an acceleration of gentrification and shrinking of the city s already fragile supply of naturally affordable housing Since the operation s inception in past lien sales have resulted in foreclosures neglect and abandonment followed by plummeting property values and less tax revenue for the city over the long term City and state housing policies are to blame for pushing a record number of affordable housing properties into economic distress not seen since the housing dilemma of the s and s In other words the property tax lien sale is a governing body creation Small building owners have no off-ramp How can they when authorities dictates both sides of the ledger They control the income side with an irrational system implemented by the Rent Guidelines Board which has underfunded rent increases for decades while on the other side of the ledger authorities keeps raising property taxes water and sewer rates and other mandates none of which are capped It s math Small owners fall behind in their property taxes and other payments because of the crushing increases imposed by governing body City Hall may as well be flying the old Soviet Union flag the red banner with the hammer and sickle like the ones we ve seen demonstrators wrapping themselves in when they re spewing their anti-American rhetoric at places like Foley Square Other destructive city and state housing policies like Albany s rent laws of which effectively defund apartment and building upgrades along with the insanity of cancel rent during the COVID- pandemic and a dysfunctional Housing Court system that allows tenants to live in apartments for months and years without paying rent has created an impossible situation for small owners Then the city punishes us with a lien sale for the mess it created The loss isn t limited to just small property owners it s to the detriment of the city tenants and neighborhoods Each foreclosure and speculative turnover contribute to the loss of affordable rent-stabilized apartments Properties are warehoused by deep-pocketed predatory investors waiting for values to rise And those tenants displaced from apartments Their lives are disrupted as they become another statistic on the city s homelessness rolls The city sells the lien sale as a financial enforcement tool but ignores the fact that it is a pipeline to the affordable housing predicament The City Council s Tax Liens Task Force has the opportunity to eliminate this regressive approach and instead implement smarter more equitable enforcement tools that would protect against destabilizing neighborhoods and that won t take generational properties from the hard-working owners upholding their family legacies of providing affordable housing to New Yorkers We offer the following recommendations to the task force and Council members like Pierina Sanchez D-Bronx Sandy Nurse D-Brooklyn and Justin Brannan D-Brooklyn who seem to recognize the terrible injustices of the tax lien sale End the sale of tax liens to private speculators and investors Create a municipal debt resolution scheme centered on housing preservation which would maintain tax revenue flow to the city keep families housed and prevent small owners from losing their buildings to foreclosure and abandonment Provide appropriate and reasonable payment plans and legal sponsorship to all small property owners Invest in solutions such as expanding and creating new targeted urgency rental assistance programs that keep families housed and equally vital enable owners to pay their property taxes municipal fees and other costs and expenses that go into maintaining and operating viable buildings Eliminating the property tax lien sale is about fairness to the small generational owners of those three-story walk ups and - and -unit tenements the backbone of affordable housing that line the landscape of every neighborhood in the five boroughs But it s more than fairness It s about preserving democracy and affordable housing in culturally diverse communities for millions of New Yorkers whose building owners know them by name and call them their neighbors That s why the lien sale must come to an end or it will be the beginning of the end to affordable housing as we know it Ann Korchak is board president of Small Property Owners of New York SPONY Lincoln Eccles is board vice president and Jan Lee is a board member of the advocacy organization whose membership consists largely of multi-generational small owners of affordable rent-stabilized housing across the five boroughs Eccles -unit building is on the city s lien sales list not by choice but because of the predicament created by city and state policies as the authors describe in this article The post Opinion Cancel NYC s Unfair Tax Lien Sale appeared first on City Limits